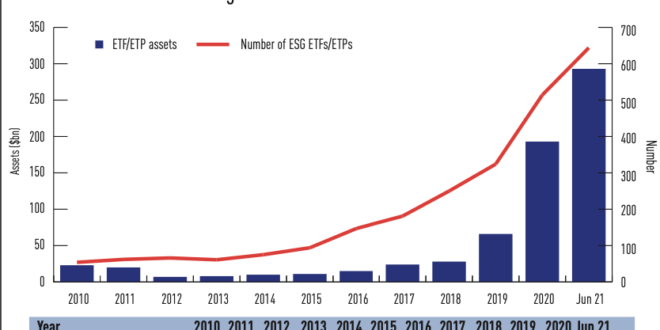

The number of ETFs (exchange-traded funds) available to investors also continues to increase. But what exactly is an ETF?

An ETF fund allows investors to buy into large groups of stocks, bonds, or other securities without purchasing each one individually. This makes it easier for individuals with limited capital to participate in the markets, because they can use one investment to gain exposure to an entire asset class.

What Are ESG EFTs?

ESG ETFs are similar to traditional ETFs, but the difference is that an ESG fund will invest in companies that have positive environmental and social practices. The idea is that these investments have a positive impact on society, so by investing in them, you’re doing good while also making money.

For example, ESG ETFs may exclude tobacco or fossil fuel companies from the portfolio because these stocks are considered unethical investments. Other ESG ETFs may avoid certain industries, such as gambling or weapons manufacturing.

ESG ETFs also aim to include companies that are more sustainable in their operations and produce less waste and pollution. For example, an ESG fund might include solar energy companies over fossil fuel companies in its portfolio because it’s better for the environment and future generations.

What Are Single Theme ETFs?

Like conventional ETFs, single-theme ETFs offer investors exposure to a particular market segment or industry. But unlike conventional ETFs, which typically hold hundreds or thousands of stocks, single theme ETFs typically hold just 20 or 30 companies.

This benefit is that it allows investors to gain exposure to industries or sectors that other ETFs don’t represent. For example, if you wanted to invest in the fast-growing medical cannabis sector but didn’t want to buy individual stocks, you could use a medical marijuana ETF instead.

When you invest in a single-theme ETF, you’re betting on one particular sector of the economy to perform well. For example, if you want to bet on banks to do well this year, you might buy an ETF that invests only in banks. If your prediction comes true and the banks do well this year, then your investment will also do well because your fund’s investments will go up in value.

But if your prediction is wrong and the bank sector does not do as well as expected, then your investment will not fare so well. This makes single-theme ETFs high-risk/high-reward investments, which can be very profitable when they work out but costly when they don’t work out as planned.

On the other hand, broad-based ETFs invest in many sectors at once, so they’re less risky than single-theme ETFs because they have more diversification built into their strategies. But they also have lower potential returns than single-theme ETFs because they invest across multiple sectors instead of just one.

What Is the Difference Between ESG EFTs and Single Theme EFTs?

ESG ETFs and single theme ETFs are both investment vehicles that provide exposure to a specific theme, such as a sector or industry. While there are many similarities between both types of funds, there are also some key differences.

The main difference between ESG ETFs and single theme ETFs is that ESG ETFs are designed to reflect the environmental, social, and governance factors that influence companies’ long-term profitability. ESG factors include:

Governance

Represents how well a company manages its business activities by incorporating policies and practices that align with the interests of its shareholders, employees, customers, and the community at large.

Governance is considered a vital component of ESG investing because it impacts the long-term value of an investment. Sustainable business models tend to provide better returns over time than those focused on short-term profits alone.

Environment

Reflects how well companies manage their impact on the environment through their products and services, including resource consumption and waste management practices.

Social Impact

Does the company offer fair labor practices? Does it pay its employees above minimum wage? Does it provide benefits like health insurance and retirement savings plans?

In Conclusion

ESG ETFs are designed to invest in companies that are socially responsible. They do this by screening for certain factors, such as whether the company is environmentally friendly or has good animal welfare practices.

Single-theme ETFs, meanwhile, may focus on a specific area of the market, such as clean energy or robotics. These ETFs may not necessarily be ESG compliant, but they do have a common theme that they follow.

The main difference between the two is the underlying investment strategy and how they decide what companies to buy and sell. Also, an ESG fund will usually be sector neutral while a single-theme fund will be sector specific.